சமீபத்திய செய்திகள்

குடும்பத்துடன் விடுமுறையை கொண்டாடும் இயக்குனர் பாக்யராஜ்

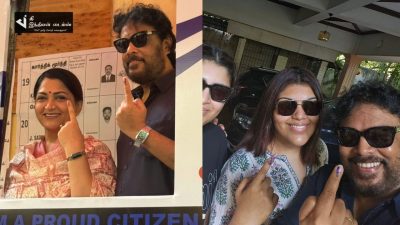

இயக்குனர் பாரதிராஜாவிடம் துணை இயக்குனராக பணிபுரிந்து இயக்குனராக அறிமுகமாகி பின்னர் நடிகராக விஸ்வரூபம் எடுத்தவர் பாக்கியராஜ். பல வெற்றிப்படங்களை தமிழ் சினிமாவில் கொடுத்து நடிகர் …

நீங்க வந்த பிறகு SHOW நல்லா போச்சு… வெளிய வந்த பிறகு… மணிமேகலையை பங்கமாக கலாய்த்த பாலா… COOK WITH COMALI

விஜய் தொலைக்காட்சியில் ஒளிபரப்பாகி வரும் குக் வித் கோமாளி நிகழ்ச்சி மக்களிடம் மிகவும் பலத்த வரவேற்பினை பெற்றுள்ளது.சிறிய செடி போல ஆரம்பித்த இந்த நிகழ்ச்சில் மக்களின் பேராதரவால் தற்போது அசைக்கமுடியாத ஆலமரம் ஆக உருவெடுத்துள்ளது.மூன்று …

இவங்களாம் கோமாளியா? எங்கய்யா மணிமேகலை குரேஷி சுனிதா எல்லாம்?

விஜய் தொலைக்காட்சியில் ஒளிபரப்பாகி வரும் ரிலியலிட்டி நிகழ்ச்சியில் மிகவும் பிரபலமான ஒன்று குக்கு வித் கோமாளி.இந்த நிகழ்ச்சி மக்களிடம் மற்றும் குழந்தைகளிடமும் நல்ல வரவேற்பை பெற்றுள்ளது.கோமாளியாக வந்து பிரபலங்கள் செய்யும் கலாட்டா காண்பவர்களை குலுங்கி …

வந்த உடனே புகழை வெளுத்தெடுத்த காளையன்.. வசமா சிக்கிய புகழ்.. குக் விதி கோமாளி சீசன் 4 Promo

தமிழில் மூன்று சீசன்களை வெற்றிகரமாக முடித்து நான்காவது சீசனில் களம் இறங்கியுள்ளது குக் வித் கோமாளி .இந்த நிகழ்ச்சிக்கு மக்கள் மத்தியில் பெரும் ஆதரவு உள்ளது.சிறியவர்கள் முதல் பெரியவர்கள் வரை இந்நிகழ்ச்சிக்கு ரசிகர்கள் ஆக …

வந்தாச்சு குக் வித் கோமாளி சீசன் 4.. வெளியாகிய அதிரடி PROMO… கொண்டாட்டத்தில் ரசிகர்கள்

தமிழில் மூன்று சீசன்களை வெற்றிகரமாக முடித்து நான்காவது சீசனில் களம் இறங்கியுள்ளது குக் வித் கோமாளி .இந்த நிகழ்ச்சிக்கு மக்கள் மத்தியில் பெரும் ஆதரவு உள்ளது.சிறியவர்கள் முதல் பெரியவர்கள் வரை இந்நிகழ்ச்சிக்கு ரசிகர்கள் ஆக …

COOK WITH COMALI நிகழ்ச்சியில் கலந்துக்கிட்டது ரொம்ப அசிங்கமா இருந்துச்சு வெட்கமா இருந்துச்சு..கண்ணீர் விட்டு கதறிய மணிமேகலை

தமிழில் இரண்டு சீசன்களை வெற்றிகரமாக முடித்து மூன்றாவது சீசனில் களம் இறங்கி அதிலும் வெற்றிபெற்றுள்ளது குக் வித் கோமாளி .இந்த நிகழ்ச்சிக்கு மக்கள் மத்தியில் பெரும் ஆதரவு உள்ளது.சிறியவர்கள் முதல் பெரியவர்கள் வரை இந்நிகழ்ச்சிக்கு …